In recent years, the insurance industry has rapidly evolved, focused on upgrading robust and proven workflows with fast, streamlined, digital customer experiences across many communication channels.

IN2 helps insurers evolve their operations and customer engagement practices to keep up with new trends in a way that creates more value, accelerates processes, and increases customer satisfaction and profitability.

Delivered by a team of thoroughbred insurance business experts. Proven at billion euro+ revenue insurers and within the European claims community.

With IN2you’re not buying software development or universal platform tools. Instead, you’re gaining a rare chance to access 80% preconfigured digital insurance solutions based on best industry practices, distilled from 30 years of experience building and evolving core solutions.

Here are three specific and mission-critical ways in which we help:

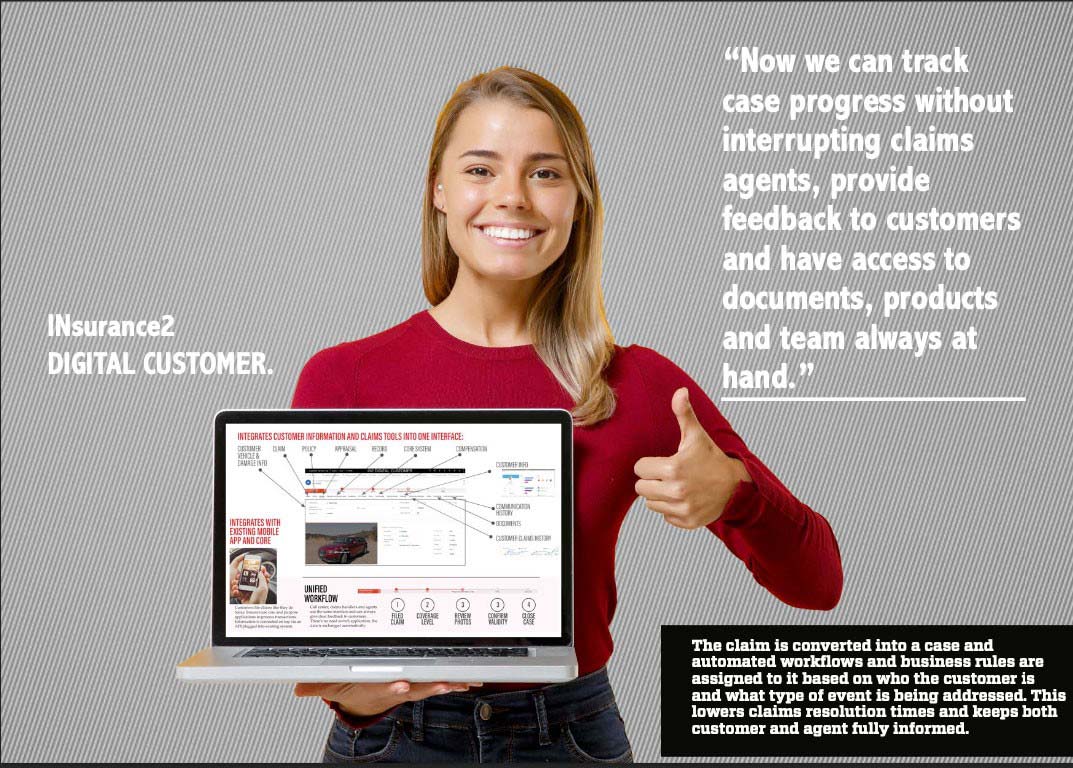

Customer-centric and customer-facing interactions in claims, support, and sales operations.

Built as IN2’s proprietary modules on top of the proven Microsoft Dynamics 365 platform, INsurance2 DIGITAL CUSTOMER combines deep insurer operations and business knowledge with a world-class, stable, and scalable environment.

It supports more than 30 specific insurance business workflows and comes 80% pre-configured, allowing for quick 8-12 month implementation sprints (instead of several years). Taking the basics of 360 Degree customer view, KYC, and communication to the next level.

It is fully plugged into the INsurance2 DIGITAL integration platform, which connects into all insurer existing core and back systems (regardless if from IN2 or other vendors) and exchanges data from all those systems and also manages user rights, auditing, and compliance.

It also includes the Remote Appraiser functionality of capturing claims damage evidence remotely.

80% of the solution comes pre-configured, with the remaining 20% open for quick customizations or in-depth configurations by the internal IT team or existing partners. This strikes an optimal balance of high implementation speed, fair cost, and access to best-in-class workflows without sacrificing insurer brand and process distinctiveness.

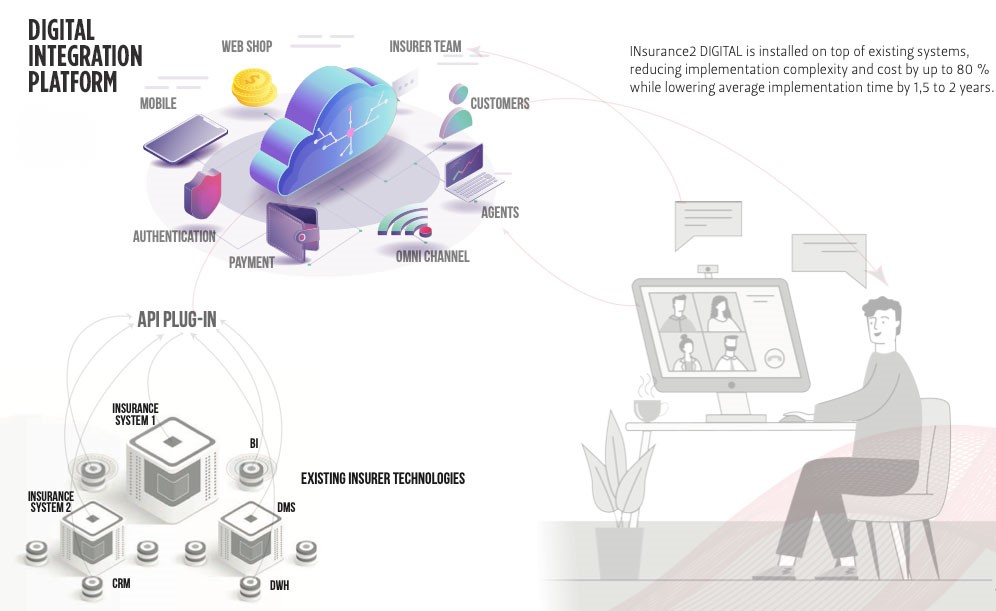

The core-to-digital integration and data orchestration platform ends the problem of countless and expensive-to-maintain point-to-point integrations. Works with the IN2 core system and other vendor system, is well suited for multi-core integration scenarios.

INsurance2 DIGITAL is bolted on top of existing core and back systems. It organizes all insurer information from various core, document and other legacy technologies into a standardized 500-point data model. It extends APIs to those systems, supporting faster future integrations.

For example providing the ability to quickly add external data sources, 3rd party or partner systems, and cloud-based services (for example, emerging AI tools).

The platform’s impact is significant, cutting down integration times from months or even years to weeks. Its critical financial benefit comes from insurers keeping their existing core systems when adding digital services, not being forced to go through a core swap, and its inherent high risks and costs.

Most integrations mean that different systems use the same APIs, so instead of doing them individually for every app, you gain a unified API catalog to connect new services and user experiences. Taking care of monitoring, auditing, and compliance.

The back-end core solution for life and non-life insurance scenarios.

This is where every insurer’s IT journey began, as did that of IN2 in insurance – the core system. Engineered and built 25 years ago, it has continuously evolved, becoming a complete, highly insurance-specific workhorse of a transactional engine. This is where the IN2 team drew their experience from.

Working with customers on thousands of unique change requests, fine tuning and evolution of workflows and functionalities. This comprehensive but easy-to-maintain and scale product is fully compatible with the INsurance2 DIGITAL integration platform and, by extension, with INsurance2 DIGITAL CUSTOMER. This allows us to serve our existing customers looking to upgrade the core. We are also in a great position to support greenfield deployments in subsidiary companies, putting in place the core bellow higher layer digital channels, connectivity and customer interaction functionalities. The product is kept in constant evolution.

Digital standard and 8-12 month implementation sprints

A notable aspect of INsurance2 DIGITAL solutions is the way we approach implementation

Adhering to our proprietary Insurance Digitalization Standard, we put a 500-point data model in place and organize workflows, roles, authentication, APIs, and similar dimensions needed for the insurer to achieve efficient operations and simple maintenance and support scenarios.

When a solution is implemented and gradually rolled out at the parent company or first subsidiary, it can be scaled to the rest of the insurer’s business group. And lastly, thanks to having internal and customer operations well organized and connectivity solved through the platform, new AI and automation technologies can easily be added and modulated to evolve processes further and increase margins. As mentioned above, our digital offering does not require the use of the INsurance2 core system, these are core agnostic technologies, yet benefiting from our extensive experience in work with legacy technology.

Digitization projects of Croatian healthcare, justice, maritime transport, commercial economic IT projects, as well as projects in the fields of insurance and finance, which facilitate the daily life and work of our citizens and business entities, are the greatest achievement of IN2 group.